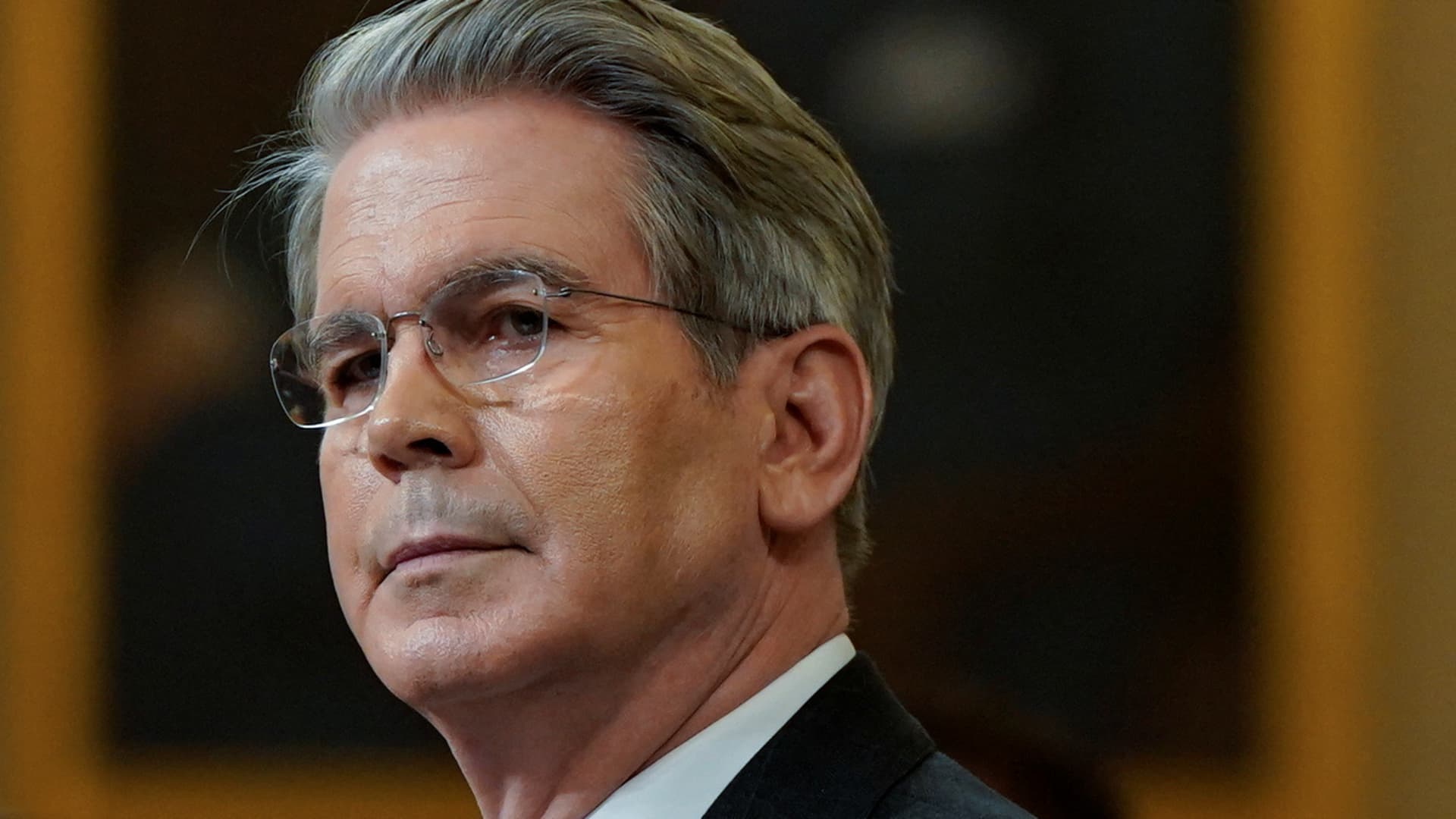

U.S. Treasury Secretary Scott Bessent sits to testify before a House Ways and Means Committee hearing on Capitol Hill in Washington, D.C., U.S., June 11, 2025.

Elizabeth Frantz | Reuters

With the job market currently being rough for many — in no small part because of artificial intelligence — it may be tempting to enroll in graduate school in the hopes of securing a better job eventually.

Don’t do it. That is, if you have dreams of working at America’s central bank.

U.S. Secretary of Treasury Scott Bessent on Monday questioned the Federal Reserve’s decision not to lower interest rates this year so far, given that the U.S. has “seen very little, if any, inflation.”

“I think this idea of them not being able to break out of a certain mindset,” Bessent said, referring to Fed officials. “All these Ph.D.s over there, I don’t know what they do.”

The headline number for June’s consumer price index was the highest since February.

While navigating the job market has been a challenge regardless of qualifications, the stock market seems to be on a smooth path upward regardless of challenges.

The S&P 500 broke the 6,300 closing level for the first time on Monday. That’s despite the Trump administration’s beef with the Fed and its use of heavy tariffs as a bargaining tool.

Under those circumstances, an investor doesn’t need a Ph.D. to know that volatility in markets could lie ahead despite the positive sentiment today.

What you need to know today

Scott Bessent calls for a review of the Federal Reserve. In an interview with CNBC on Monday, the U.S. Treasury Secretary suggested that the government needs to examine the “entire” Fed to assess if it has been “successful.”

Tariff deadlines will ‘put more pressure’ on countries. Bessent, in the same interview, said that the upcoming Aug. 1 deadline will help the U.S. reach “better agreements” with its trade partners, suggesting it could be used as a negotiating tool.

The S&P 500 closed above 6,300 for the first time. Boosted by advances in Meta and Amazon shares, the Nasdaq Composite notched a record closing high as well. Across the Atlantic, the Stoxx Europe 600 dipped 0.08%.

Trump Media has built a roughly $2 billion bitcoin hoard. Those holdings now account for about two-thirds of Trump Media’s total liquid assets, signaling U.S. President Donald Trump’s pivot to cryptocurrency as a source of wealth while in office.

[PRO] European small caps have room to grow. A weak dollar and expectations of an improving regional economy were giving small caps a boost, said a Goldman Sachs strategist, who also explained why they are outperforming larger companies.

And finally…

Jensen Huang, chief executive officer of Nvidia Corp., speaks to members of the media in Beijing, China, on Wednesday, July 16, 2025.

Na Bian | Bloomberg | Getty Images

Nvidia’s China return buys time for Beijing to boost its chip drive

When Nvidia said it planned to resume chip shipments to China, seemingly with the blessing of Washington, it sparked debate over the strategic implications for the U.S.′ dominance in AI and China’s own focus on boosting its domestic chip and tech industry.

For the U.S., Nvidia’s return could help cement American strength in AI globally, experts told CNBC. For China, it could buy the country time as it continues on its own path to build Nvidia rivals and keep pace with AI software development.

— Arjun Kharpal